KREOS INSIGHTS NEWS NEWSLETTERS PORTFOLIO

BlackRock, Inc. announces the closing of its acquisition of Private Debt Manager Kreos Capital

London – August 2nd, 2023 – BlackRock Inc. (NYSE: BLK) announces today the completion of its acquisition of Kreos, a leading provider of growth and venture debt financing to companies in the technology and healthcare industries.

KREOS INSIGHTS NEWS NEWSLETTERS PORTFOLIO

BlackRock, Inc. to Acquire Private Debt Manager Kreos Capital

L Accelerates growth of BlackRock’s Credit platform with a complementary acquisition providing clients with access to growth and venture debt lending strategies.

NEWS

CTERA Doubles Down on The Channel, Launches Global Partner Program

CTERA, the leader in edge-to-cloud file services, today announced its new global partner program, designed to empower resellers, managed service providers and system integrators to become trusted advisors in secure multi-cloud data management.

NEWS

Sylq selects ThetaRay AI to automate AML transaction monitoring and customer screening

Sylq, the French e-payments leader, and ThetaRay, a leading provider of AI-powered transaction monitoring technology, today announced a new collaboration to implement high-performance AI transaction monitoring and automated customer screening to support company growth.

NEWS

HiBob’s CPO Nirit Peled Muntz Recognized as a Top Leader in Diversity, Equity, and Inclusion by Mogul

HiBob, the company behind Bob, the modern HR platform that powers productivity, engagement and retention, today is proud to announce its Chief People Officer, Nirit Peled Muntz has been named to Mogul’s Top 100 list of People Leaders and CHROs.

NEWS

Ironwood Enters into Definitive Agreement to Acquire VectivBio, a Clinical-Stage Biotech Company Pioneering Novel Treatments for Severe Rare Gastrointestinal Diseases

Ironwood Pharmaceuticals, Inc. (“Ironwood”) (Nasdaq: IRWD), a GI-focused healthcare company, and VectivBio Holding AG (“VectivBio”) (Nasdaq: VECT), a clinical-stage biopharmaceutical company pioneering novel, transformational treatments for severe rare gastrointestinal conditions, today announced that they have entered into a definitive agreement for Ironwood to acquire VectivBio for $17.00 per share in an all-cash transaction...

NEWS

NeuroBlade Announces Industry’s First Processor for Analytics, Speeding Workloads up to 100x

NeuroBlade, pioneering the new standard for data analytics acceleration that will speed time to insight and improve query performance on petabyte-sized datasets, today announced that the NeuroBlade SQL Processing Unit (SPU™) will be available with select Dell Power Edge servers.

NEWS

Recharge.com accelerates growth for digital gift card services as European market expected to reach $64 billion this year

European branded payments company Recharge.com today announced its key role in accelerating growth across new markets in Europe, due to reach $64 billion in 2023.

NEWS

Citi and TIS Launch Next-Generation Cash Flow Forecasting and Working Capital Insights for Companies

NEW YORK – Citi’s Treasury and Trade Solutions (TTS) has expanded its relationship with Treasury Intelligence Solutions (TIS), a global leader in cloud-native cashflow, liquidity, and payment solutions. Joint clients may now, through Citi, gain access to TIS’ innovative cash forecasting and working capital platform....

NEWS

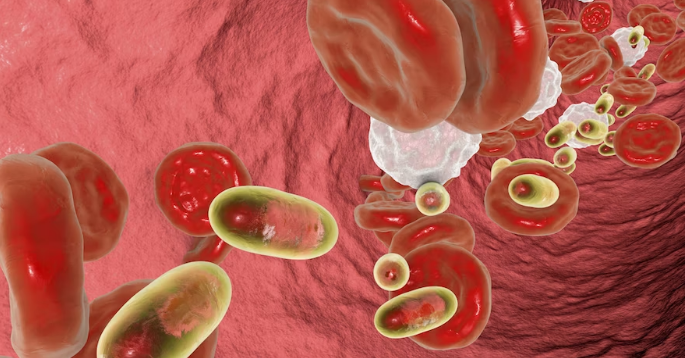

Siemens Healthineers to distribute Scopio Labs’ full-field digital cell morphology technology

Siemens Healthineers on Monday announced an agreement to distribute Scopio Labs’ full-field digital cell morphology technology, which will enable clinical laboratorians to examine patient blood cell samples digitally instead of under a microscope.

NEWS

PPRO partners NPCI International for UPI access

Digital payments infrastructure provider PPRO has partnered with NPCI International Payments Limited (NIPL) to offer global partners access to UPI for cross-border transactions.

NEWS